What is CDD / SDD / EDD in Banking? 🕵

Par un écrivain mystérieux

Last updated 07 juillet 2024

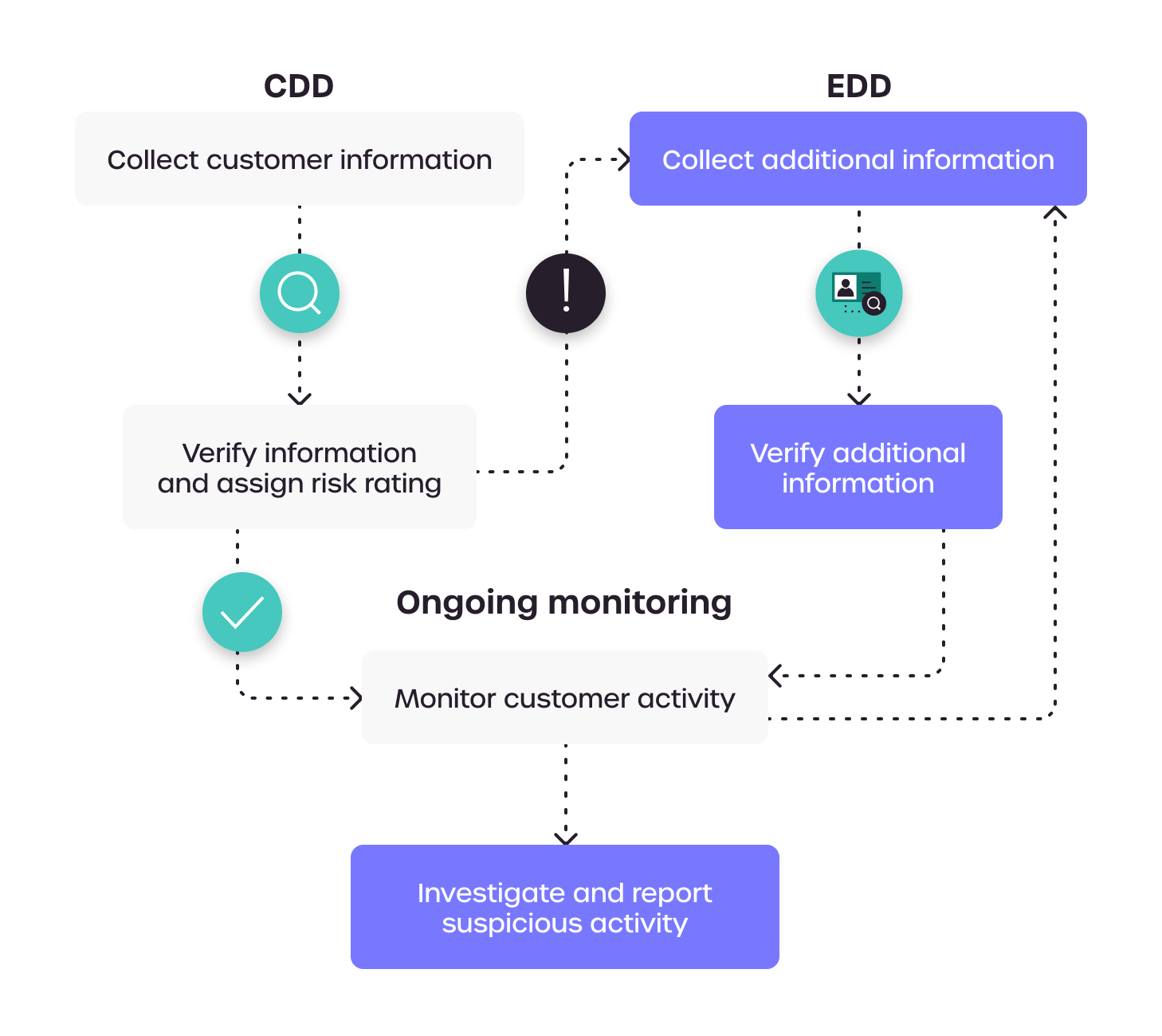

Due diligence is a process or effort to collect and analyse information about your customer before making a decision or conducting a transaction so that the reporting entity is not held legally…

Anna Stylianou on LinkedIn: #cdd #edd #aml #amlawareness #amlcft

What is Customer Due Diligence (CDD)?

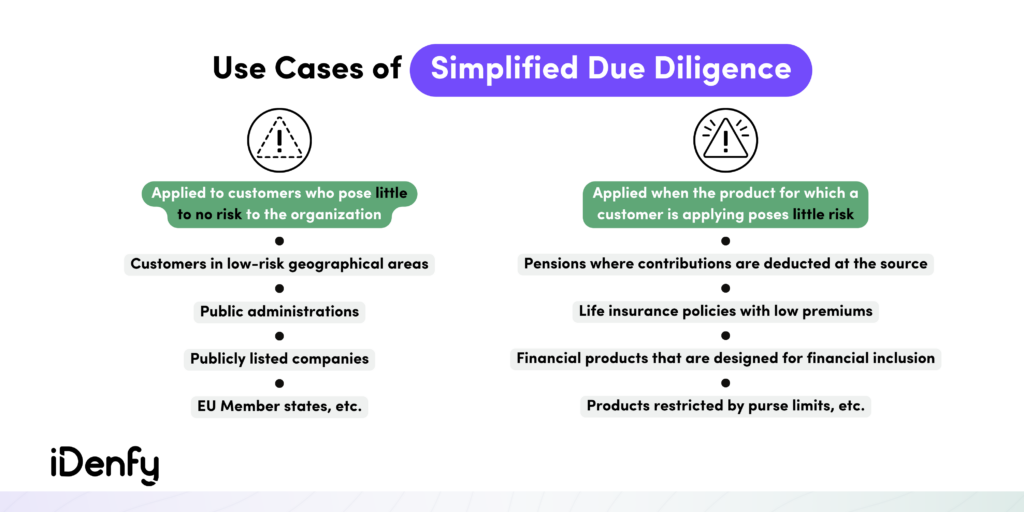

A Quick Guide to Simplified Due Diligence (SDD) - iDenfy

CDD & EDD – what are they and when are they needed? - KYC-Chain

What is customer due diligence in banking and financial services?

What is the Difference Between KYC and CDD? - iDenfy

Key elements of EDD The Enhanced Due Diligence in Banking

Due Diligence: When to Conduct CDD, EDD and SDD

5-Steps to Improve Customer Due Diligence Process

Recommandé pour vous

Hard Drives (HDD) vs Solid-State Drives (SDD)14 Jul 2023

Hard Drives (HDD) vs Solid-State Drives (SDD)14 Jul 2023 SSD vs HDD: What's the Difference & Which Is Best?14 Jul 2023

SSD vs HDD: What's the Difference & Which Is Best?14 Jul 2023 SSD vs HDD, Compare SDD and HDD14 Jul 2023

SSD vs HDD, Compare SDD and HDD14 Jul 2023 Korg SDD-300014 Jul 2023

Korg SDD-300014 Jul 2023 SDD Ref. BMed TCW4000SDD E003-09314 Jul 2023

SDD Ref. BMed TCW4000SDD E003-09314 Jul 2023 Creative initial letter sdd logo design concept Vector Image14 Jul 2023

Creative initial letter sdd logo design concept Vector Image14 Jul 2023 Korg SDD-3000 Programmable Digital Delay Vintage Rare Effect14 Jul 2023

Korg SDD-3000 Programmable Digital Delay Vintage Rare Effect14 Jul 2023- SDD Supplies14 Jul 2023

Silicon Drift Detectors (SDD) : Hitachi High-Tech in the U.S.A.14 Jul 2023

Silicon Drift Detectors (SDD) : Hitachi High-Tech in the U.S.A.14 Jul 2023 Aseptic Group - What is SDD™ ?14 Jul 2023

Aseptic Group - What is SDD™ ?14 Jul 2023

Tu pourrais aussi aimer

- Mattel® Hot Wheels® Mario Kart™ Toad Mach 8 Toy Vehicle, 1 ct14 Jul 2023

TD® 3 en 1 lecteur de carte SD USB micro compact flash multifonction externe 3 ports adaptateur convertisseur memory card reader air - Cdiscount Informatique14 Jul 2023

TD® 3 en 1 lecteur de carte SD USB micro compact flash multifonction externe 3 ports adaptateur convertisseur memory card reader air - Cdiscount Informatique14 Jul 2023 Pointes de touche amovible CAT III & IV14 Jul 2023

Pointes de touche amovible CAT III & IV14 Jul 2023 Fichier STL gratuit Clef Purge Radiateur 🧑🔧・Objet imprimable14 Jul 2023

Fichier STL gratuit Clef Purge Radiateur 🧑🔧・Objet imprimable14 Jul 2023 Clé A Pipe Debouchee 6X12 Pans 20Mm Stanley 2-86-697 - Outillage14 Jul 2023

Clé A Pipe Debouchee 6X12 Pans 20Mm Stanley 2-86-697 - Outillage14 Jul 2023 Chargeur PSP, adaptateur secteur de remplacement Chargeur mural d'alimentation compatible avec Sony PSP-110 PSP-1001 PSP 1000 PSP Slim & amp; Lite14 Jul 2023

Chargeur PSP, adaptateur secteur de remplacement Chargeur mural d'alimentation compatible avec Sony PSP-110 PSP-1001 PSP 1000 PSP Slim & amp; Lite14 Jul 2023 AudioFly AF56W Noir - Écouteurs intra-auriculaires Bluetooth - Casque / Écouteur - AudioFly14 Jul 2023

AudioFly AF56W Noir - Écouteurs intra-auriculaires Bluetooth - Casque / Écouteur - AudioFly14 Jul 2023 Bâche de protection pour piscine Intex autoportante ronde14 Jul 2023

Bâche de protection pour piscine Intex autoportante ronde14 Jul 2023 Pingouin - Pelote de Laine PINGO DOUCEUR 6 de 50g - Laine à Tricoter - 100% ACRYLIQUE - Aiguille n°6 - Couleur JAUNE CLAIR14 Jul 2023

Pingouin - Pelote de Laine PINGO DOUCEUR 6 de 50g - Laine à Tricoter - 100% ACRYLIQUE - Aiguille n°6 - Couleur JAUNE CLAIR14 Jul 2023- JETech iPhone 12 Pro Max Case Bumper Cover, Shop Today. Get it Tomorrow!14 Jul 2023